Prem Watsa, the chairman and CEO of Fairfax Financial Holdings Ltd (TSE:FFH) warned that investors who own technology stocks including Twitter Inc (NYSE:TWTR) will end up hurting because their prices are unsustainable, but he remained confident with his bet on BlackBerry Ltd. (NASDAQ:BBRY) (TSE:BB).

Watsa delivered his warning during the annual shareholder meeting of Fairfax Financial Holdings Ltd (TSE:FFH) in Toronto on Wednesday, April 9. According to him, “There’s nothing underlying the value of these companies.” He was referring to a chart showing the price-to- earnings ratio (P/E Ratio) of Facebook Inc (NASDAQ:FB), Netflix, Inc. (NASDAQ:NFLX), and Twitter Inc (NYSE:TWTR).

“This is going to end in tears because it always has. Someday the music is going to stop and all these companies are going to come down quite dramatically. The last time this happened was in the dot-com era. This will end in tears,” said Watsa.

Extra-ordinary speculation

Last month, Watsa stated a similar view regarding technology companies in his annual letter to shareholders. He pointed out the market valuation of the tech companies he compiled were based on “extra-ordinary speculation.” In fact, he specifically mentioned Twitter Inc (NYSE:TWTR) as grossly overvalued and compared it with the valuation of BlackBerry Ltd. (NASDAQ:BBRY) (TSE:BB).

According to him, at the time of the initial public offering (IPO) of Twitter Inc (NYSE:TWTR), it had $665 million revenues and $645 million losses and most investors had difficulty acquiring its stock unless they were very good clients of its underwriters. The popular microblogging company IPO price was $26 a share giving it an $18 billion market valuation.

On the other hand, BlackBerry Ltd. (NASDAQ:BBRY) (TSE:BB) just announced its convertible debt issue at the time. The Canadian smartphone manufacturer traded more than 100 million shares at $6 a piece giving it a market value of $3 billion. He pointed out that BlackBerry had around $8 billion revenues with $2.6 billion cash and no debt aside from the convertible debt to be issued.

Watsa said, “If you thought that Twitter was grossly overvalued at $26 per share, it promptly doubled. This sort of speculation will end just like the previous tech boom in 1999 to 2000 — very badly!”

BlackBerry investment

Fairfax Financial Holdings Ltd (TSE:FFH) is the largest shareholder of BlackBerry Ltd (NASDAQ:BBRY) (TSE:BB) with approximately 10% stake in the company.

Watsa considers the struggling Canadian smartphone manufacturer as a good value investment and he is confident that its performance will improve over the long-term. He said, “We think over time BlackBerry is going to do well.”

He also praised the performance of BlackBerry CEO John Chen in reviving the profitability of the company. According to him, “John, in five months, has done so many changes. We’re very impressed. He’s hit the road running.”

BlackBerry equity risk

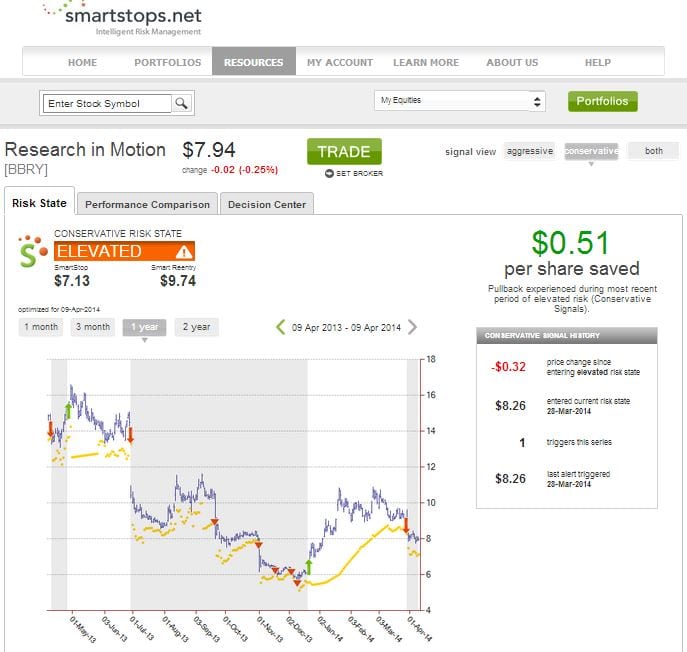

The stock price of BlackBerry Ltd (NASDAQ:BBRY) increased by 1.76% to $8.10 per share after hours in New York. The stock traded from $5.44 to $16.59 per share over the past 52-week range. Smartstops.net, an equity risk management firm shows that the shares of the Canadian smartphone manufacturer is currently at an elevated risk state.

Meanwhile, Zacks Equity Research has a Buy rating for the stock and suggested that it is the right time to own the stock after its recent decline. Investors planning to invest in the stock because it is cheap compared with the other tech stocks should take advantage of the risk management tools offered by Smartstops.net to protect their investment. The firm’s proprietary analysis produces a risk price point that can be used proactively in the next day’s market or the service will alert you in real-time to an “elevated” risk state indicating a high probability of a continued decline in the equity’s price.