The reasonable market business esteem is a gauge of the monetary estimation of a proprietor’s premium in a business, in light of a safe distance’ exchange where a purchaser and vender, uninhibitedly concur upon an incentive with admittance to all data. Three valuation approaches can assess a business’ honest evaluation: the pay approach which sees the revenue source; the market approach which sees the selling products; and the resource approach which sees the resource esteem. Business evaluations are driven by four worth drivers: the noteworthy revenue source, the future net income, the market estimation of the investors’ value and the markdown rate.

The Income Stream

We should start with the revenue source. The estimation of any business is in its profit power since a speculator hopes to pre-tax profits for their venture. A privately owned business regularly has costs that another proprietor probably won’t pay if the business was sold. These optional costs may be: abundance proprietor’s compensation, related gathering exchanges, for example, paying above-market rents to another organization constrained by the entrepreneur, or, special or operational expense that were for individual use or essentially to diminish the pre-charge benefits of the business to reduce the duty bill. To gauge the memorable revenue source, we start with the ‘bookkeeping net benefit’ from the pay articulation.

To mirror the real re-visitation of the entrepreneur, we add back any acclimations to benefit that mirrors a precise portrayal of the income force of the organization. All abundance proprietor’s remuneration and any optional costs are added back to the benefit.

On the off chance that the proprietor is performing standard administration obligations, at that point just the compensation above what might be needed to recruit somebody to play out those obligations ought to be added back. It isn’t unexpected to see ‘once’ charges in an organization’s financials. Once charges are costs that are not liable to happen once more. This may be a record of resources or a one-time offer of a resource, and so on In the occasion there is a one-time charge, this ought to be added to the benefit base since this cost won’t be an on-going cost. It is a typical slip-up in valuations not to report every change. Have an away from and clarification of every change.

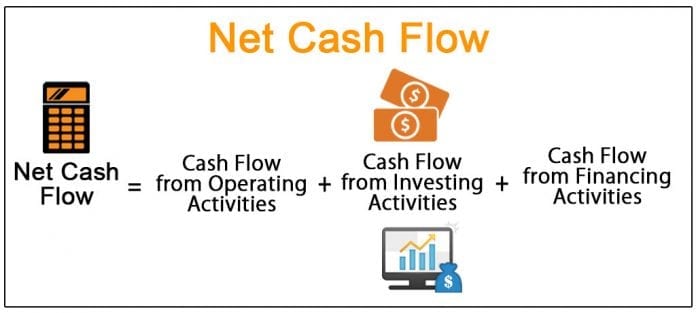

Future Income Net Cash Flow

The future pay net income of a business is the future monetary advantage a proprietor hopes to get. The revenue stream can be communicated on the other hand, for example, income before interest and charges (EBIT) or EBITDA, if deterioration and amortization are incorporated. Free income (benefit in addition to deterioration and amortization less capital uses and the net change in working capital) is once in a while used. According to stonebridgema.com, “Proprietor’s Discretionary Cash” (ODC) is regularly utilized in business valuations and is characterized as EBITDA, less capital consumptions and working capital changes. Devaluation strategies are taken out from the condition, and income before premium and obligation installments are utilized, which archives the money accessible to the investors and obligation holders. A purchaser is buying the future income of the business, so the future net income is basic to figure.

The Market Value of the Stockholders’ Equity

The market estimation of the investors’ value is likewise called book esteem. This strategy deducts the market estimation of the absolute liabilities from the market estimation of the all out resources. Most inconsistencies will probably be found in the fixed resources, intangibles or speculation (protections) accounts. Resources are bought and recorded at cost and afterward devalued over reasonable recuperation periods.

Frequently, resources have been recorded fundamentally and may even be ‘off’ the accounting report, however they are still completely used in tasks. This is especially obvious with structures where they normally appreciate instead of deteriorate. Because of customary bookkeeping rehearses, we need to make the important changes in accordance with mirror the market estimation of the resources and liabilities to show up at the net resource esteem. The net resource esteem is normally the most minimal valuation while esteeming an on-going business as the revenue stream investigation typically produces a higher worth.

Rebate Rate

The rebate rate is the last valuation driver. The markdown rate is utilized to introduce esteem the future incomes. High danger speculations request higher paces of return. The rebate rate is a speculator’s normal pace of return, given a particular danger level for the venture. Appraisers utilizes a “development” technique to decide the rebate rate. The US 20-year depository bill speaks to moderately hazard-free speculation.

Value speculations convey an additional Equity Risk Premium and is distributed by monetary announcing organizations. A solitary organization hazard isn’t enhanced and conveys added hazard. Subsequently, a Company Specific Risk Premium is dictated by the qualities of the business and their capacity to meet long haul commitments. This estimation is maybe the most moving number to approve. Every industry has its own danger factor, and the Industry Risk Premium is utilized. By adding these four danger charges, we show up at the Cost of Equity. Subsequent to applying a weighted normal expense of value, we show up at the “Markdown Rate.” Next, we deduct the development pace of the organization which is generally the experienced development pace of the organization. Regularly, the development rate ought not surpass the pace of swelling in addition to GDP development. Deducting the development rate from the rebate rate gives us the capitalization rate (cap rate) which will be utilized to underwrite one year of income.

Set aside some effort to precisely create and apply the right qualities. In the event that there are disparities in a valuation, it is typically found in these four regions.