Tesla Motors Inc (NASDAQ:TSLA) hit another record-high when its shares traded around $259.20 per share at one point today. The stock closed at $248 per share, an increase of nearly 14%. The stock price of the company was lifted primarily by the bullish report released by Morgan Stanley analyst, Adam Jonas suggesting that t will be able to double its market share in the auto industry worldwide by 2028.

Jonas also suggested that Tesla Motors Inc (NASDAQ:TSLA) could become the leading manufacturer of advance batteries due to its huge investments in battery manufacturing, thus it will be supplying battery packs to other auto makers.

“If it can be a leader in commercializing battery packs, investors may never look at Tesla the same way again. If Tesla can become the world’s low-cost producer in energy storage, we see significant optionality for Tesla to disrupt adjacent industries,” wrote Jonas in a note to investors.

Tesla CEO Elon Musk has been frequently discussing the objective of the company to build the world’s biggest lithium-ion battery factory. During the third quarter earning conference call with analysts last year, Musk said, “This will be a giant facility. We are talking about something that is comparable to all of the lithium-ion battery production in the world — in one factory.” Musk is expected to provide more details regarding its planned battery factory this week.

Jonas also emphasized that Tesla Motors, Inc (NASDAQ:TSLA) will achieve a primary position for the two most transformational developments in the auto industry over the next 5, 10, and 20 years, which include electrification and autonomous vehicle technology.

“At some level, Tesla is an exercise in investment fundamentalism — you either believe in the commercial success of electric vehicles, or you don’t. Clearly, we believe in the adoption of electric vehicles as an increasingly viable competitor to the internal combustion engine,” said Jonas.

He raised his price target for the shares of Tesla Motors, Inc (NASDAQ:TSLA) from $153 to $320 per share. Jonas acknowledge the fact that his bullish perception on the future of the electric car manufacturer is focused on long-term return while short-term valuations remain extremely high.

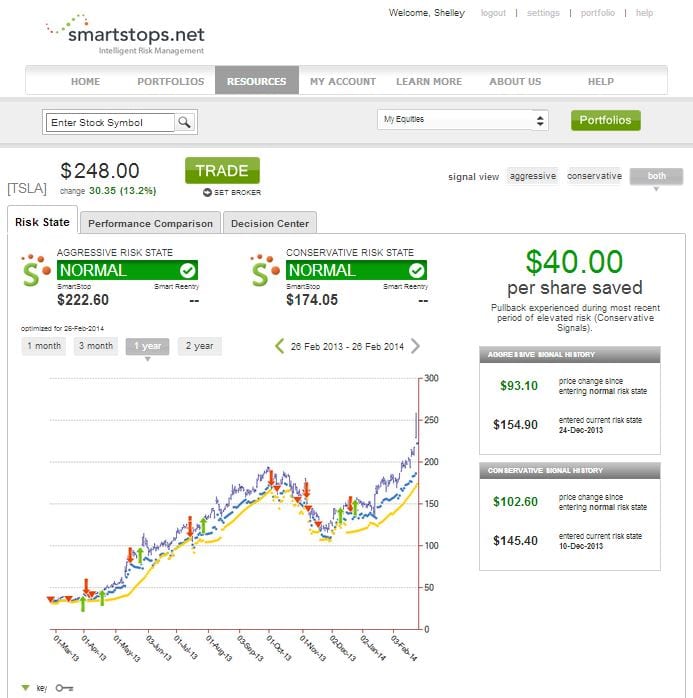

Smartstops.net, a stock market risk management service provider show that the equities of Tesla Motors, Inc (NASDAQ:TSLA) are currently in a normal risk level. Although, the perception of the market about the future of the company is generally bullish over the long-term, take note that it is still facing some legal challenges as auto dealers in several states wants to limit its expansion given its status as a manufacturer and not as a dealer. Take note that the stock price of Tesla suddenly declined due to reports that three Model S cars caught into fire last year.

It is important for investors to protect their investments from risks. Smartstops.net provides alerts to investors when the stocks in their portfolio is at risk, thus helping them save money.