You may have made some poor financial choices in the past, but that doesn’t mean you’re stuck with a bad credit score forever. There are steps you can take to rebuild your score and improve your financial standing. In this article, we’ll show you how to do just that.

The basics of credit

Credit is essentially a loan that you receive from a financial institution, and it is used to purchase items or services. When you make timely payments on your obligations, your score will improve. Conversely, if you miss payments or default on your debts, your score will suffer, , which can be mitigated by using a reputable houston tx credit repair company.

There are two main types of credit: revolving and installment. A revolving loan is typically used for short-term expenses, such as credit card bills, while installment credit is used for larger purchases, such as a car or home loan.

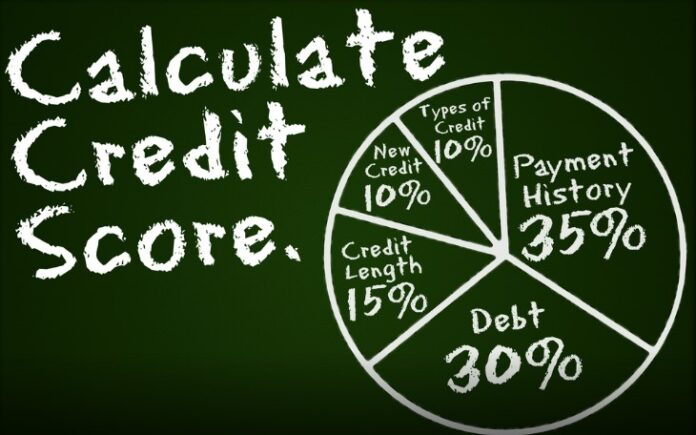

How is your score calculated?

Your credit score is calculated using a number of factors, including your payment history, utilization, length of debt history, and more. Payment history is the most important factor in the calculation, so be sure to pay all of your bills on time. Credit utilization is also a key factor, so make sure you’re not using too much of your available credit. The length of your history is also considered, so it’s important to keep your oldest accounts open and active.

A good score can help you get approved for loans and lines of credit, and can also help you get better interest rates. It can also help you rent an apartment or buy a car or even help you get a job.

You can begin to rebuild your credit as soon as you start paying off your debts

If you have bad credit, it can feel like you’re stuck in a never-ending cycle of debt. But there is hope! Credit monitoring services like Philadelphia Credit Repair can help you keep track of your score and report any changes to you. This can help you identify any potential problems early on and take steps to fix them. You can begin to rebuild your credit as soon as you start paying it off your debts.

The first step is to make a plan. Figure out how much you can afford to pay each month, and then make a budget. Once you know where your money is going, you can start chipping away at your debt.

It’s important to keep making payments on time, even if they’re only minimum payments. As you continue to pay off your debts, your score will slowly start to improve.

It might take a few years to get your score back on track, but it’s worth it! It will open up doors for better interest rates and loan terms in the future. So don’t give up – keep working at it, and eventually, you’ll see results.

It takes time and consistency

It can feel like you’re stuck in a never-ending cycle of trying to catch up on bills and make payments on time, only to find yourself right back where you started. But there are steps you can take to start rebuilding your solvency and improving your financial standing.

One of the best things you can do is to make all of your payments on time. This includes any monthly bills, such as your rent or mortgage, car payment, student loans, and credit card bills. Even if you can only make the minimum payment, it’s important to show that you’re making an effort to pay off what you owe.

You should also try to keep your credit card balances low. Using too much of your available credit can hurt your score, so it’s important to keep your balances under control. You can do this by paying down your debts and avoiding new purchases that would put you over the limit.

In addition, try to diversify your sources of loans. If all of your debt comes from one source, such as a single credit card, it can be more difficult to rebuild it. Having multiple types of loans, such as a mix of cards and a personal loan, can help show that you’re a responsible borrower.

Finally, be patient. It takes time to rebuild your solvency, and there’s no quick fix. But by following these tips, you can start to improve your score and take steps toward financial stability.

Other options for rebuilding your credit

While there are many ways to rebuild your solvency, some methods may be better suited for your situation than others. If you have a bad score, you may want to consider some of the following options for rebuilding it:

-Apply for a secured credit card: This is a great way to rebuild your solvency because it requires a deposit that acts as your line of credit. This deposit protects the lender in case you default on your payments, so they are typically willing to approve people with bad scores.

-Become an authorized user on someone else’s card: If you have a friend or family member who has good credit, you can become an authorized user on their card. This means that you will be able to use their card and build up your own credit history.

-Take out a small loan: Another option for rebuilding your score is to take out a small loan from a lending institution. Be sure to make all of your payments on time in order to rebuild your history.

-Get a cosigner: If you are having trouble getting approved for a loan or credit card, you may want to consider finding someone who is willing to cosign for you. This means that they will be responsible for making the payments if you default on the loan.

Conclusion

There’s no doubt that having bad credit can be a major obstacle in life. But it doesn’t have to be a permanent condition. With some effort and discipline, you can rebuild it and get back on track. By following the steps outlined in this article, you can create a plan to improve your score and make it easier to achieve your financial goals.