As all accounts payable managers know, AP processing is among the most manual, time-consuming, and cumbersome processes in accounting, with at least 50% of all B2B payments being made manually with paper checks today, one thing is abundantly clear.

There is a world of opportunity to save time at every step of accounts payable.

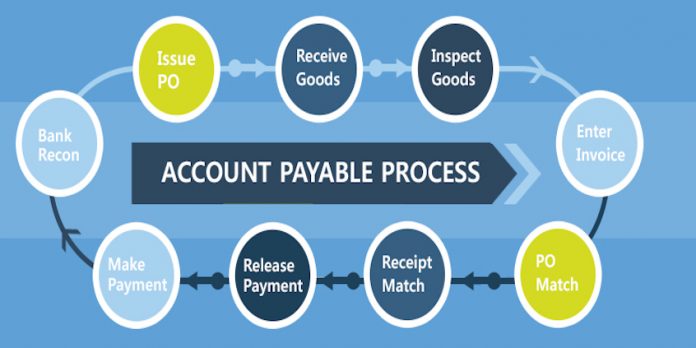

The process has a significant impact on your business’ cash flow. Streamlining your business accounts payable process can help maintain good relationships with your vendors, which can benefit you. If you haven’t found the perfect workflow for your accounts payable process. Accounts payable refers to the amount you owe suppliers for goods or services that you purchase from them on credit. Paying attention to your debt processing is very important — if anything goes wrong in your debt processing, your entire business will be in jeopardy.

Let’s say your vendor ships the item you ordered and after delivery you see that they have charged you more than the agreed amount. To prove them wrong, you search for the appropriate purchase order, but you can’t find it! It turns out that one of your employees skipped the purchase order issuance process, because getting approval was time-consuming and they didn’t want to miss the initial discount the vendor was offering. In a situation like this you are caught in a serious dilemma should you pay the vendor or not? One small mistake can mess up your debt system and your relationship with your vendors.

In this article I have listed some common problems and how to solve them. When it comes to accounts payable, there is always room for improvement.

Here are some simple tips to save time throughout your accounts payable process:

1. Automate the entire invoice-to-pay process

Investing in software by medius.com is a payable automation solution that has saved the company as much as 64 hours each month, because the key to maximizing your investment in automation is choosing a solution that automates the entire invoice process to payment, and not just the individual components in the process.

Accounts payable software that works for your business should include a suite of services that capture data, code invoices, approve invoices, match invoices to purchase orders, and post payments.

With a complete AP system, as part of a comprehensive Procure-to-Pay (P2P) solution, businesses save time as well as money.

There are solutions to every problem described above, and therefore the common divisor altogether of these solutions is automation, accounts payable automation process will improve its quality, accuracy, and speed. With manual processing out of the image, you’ll stop losing invoices, making late or double payments, or finding yourself with a negative income.

Firstly, you’ll bid goodbye to manual data entry and errors. If your suppliers provide the choice, always choose digital invoices in order that you’ll import them on to your accounting software rather than manually entering the small print. If you employ accounting software that comes with a scan-and-pay feature, you’ll snap an image of the seller invoice and upload it to capture as a sale transaction.

Most accounting software also provides automated payment reminders, which eliminates the likelihood lately or forgotten payments. This ensures that you simply never lose a vendor invoice, and helps you’ll avoid duplicate payments by keeping track of your paid and unpaid vendor invoices. Reduced manual data entry equals reduced errors. Find out more at Coupa.com.

2. Eliminate redundancies by centralizing your invoice processing

If you’re trying to save time, there’s nothing worse than paying the same invoice twice. Not only was time wasted while processing the redundant payment, but now you must also dedicate even more time to re-balance your books and reconcile with your vendor to set up a credit.

Especially for companies that have invoice processing happening in multiple locations, it’s easy to fall victim to this type of mistake. For this reason, dedicating one central location to process and pay every invoice can drastically reduce the number of times these costly mistakes happen, and save you a lot of time.

3. Simplify the process by establishing a routine and training employees

There are a lot of variables that go into every vendor payment. Some of this variety is unavoidable, but some of it is not. While the departments responsible for the invoice and the way that the vendor delivers it can be constantly changing, the way in which your team manages the process of capturing, approving, and making the payment is something that you can keep constant.

Planning ahead for how to handle each of the different types of invoices you receive can help save a lot of time. Establish consistent processes, train all employees to follow it, and then stick to that process every time an invoice is received. This will simplify your accounts payable, and enable both you and your entire company to become even more efficient through repetition of a familiar process.

4. Total Number of Invoices Processed

You also need to count how many invoices your team is able to process in that same time period. If the number is low, this is likely a sign that there are bottlenecks in your AP process that are affecting your level of efficiency and ability to process invoices on time. Consider the ramifications of continuing with a manual invoice approval. It might be time for an AP automation solution to speed up the process.

5. Minimize errors by capturing invoices in small doses

The more time you spend performing manual data entry, the more prone to mistakes you become over time. As vendor invoices trickle in, it is tempting to put off the process of capturing them to a future point in time that you can knock them all out in fell swoop. However, this practice will increase both the number of mistakes and resources required for reconciling them.

Capturing your invoices in smaller doses, or even individually, will limit errors and the amount of time you spend correcting mistakes.

Conclusion

Advantages accounts payable automation in makes creating purchase orders much quicker, most software also allows you to convert the acquisition order to a vendor invoice, and instantly match your vendor invoices to their purchase orders, rather than scrambling to seek out the right one from the pile.

If your software allows, make it mandatory to issue purchase orders for purchase transactions, you’ll then use the acquisition orders to review the orders and invoices you receive from your suppliers.