There has long been a perception of consumers turning to online retailers over high street stores because of the ability to locate and purchase the same products cheaper than they could from those with physical business locations. However, with online shopping now being as mainstream a channel as the high street, and with many big-name brands choosing to have a virtual presence as well as a brick-and-mortar one, businesses have had to adapt their approach and, as a result, the marketplace has changed. Combined with a year of societal, economic and personal upheaval for many, retail has been forced to demonstrate rapid business agility and innovate – in order not to thrive but, in many cases, simply to survive.

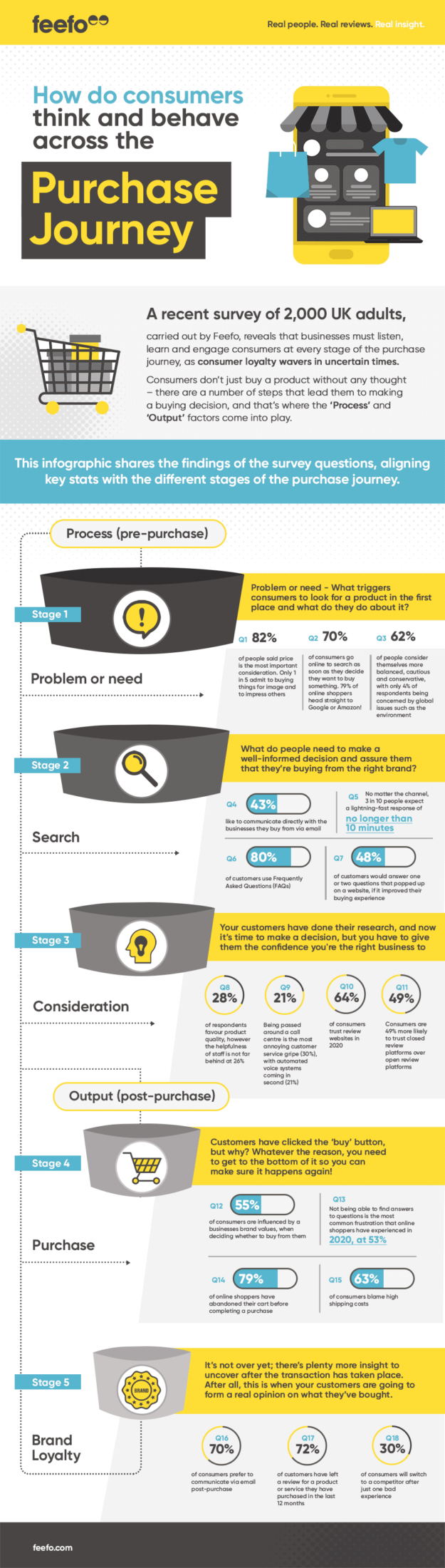

Feefo recently carried out a comprehensive survey on 2,000 of the British public to learn more about their shopping habits, on and off of the internet. The latter is definitely now considered the norm, with 70% of those surveyed saying that they go online to check products and brands as soon as they’ve made the decision to purchase something – even if they don’t quite know yet exactly what they’d like to buy. 79% of online shoppers click straight through to either Amazon or Google to browse the virtual shelves and compare items, so it’s clear that online shopping habits are already well established and that brand trust is integral.

Feefo Head of Digital, Richard Tank says ‘While Google’s online monopoly on the web has long been documented, it’s clear that Amazon is now just as prominent as the search engine, even though it’s technically an online retailer. It’s important to recognise that while consumers may start their search on these websites, they often end up buying from somewhere else. Today’s digital landscape is ever-changing and businesses have to meet the needs of their customers across the whole purchase journey in order to maintain sales and brand loyalty. The findings of this survey emphasise that.’

It is no secret that society is more ‘mobile’ than ever and 2025 has certainly seen further technological integration into the everyday lives of many. As ‘to google’ becomes a verb recognised by the Oxford English Dictionary, ‘Alexa’ known as a digital assistant rather than a common name, and as the concept of localised delivery driver hubs rolls out across all corners of the world, it is no surprise that consumer’s purchase habits are greatly impacted by – and rapidly adapting toward – the online space. Whilst this may seem daunting, particularly for smaller businesses who don’t have the resources at their disposal of larger, already well-known brands, there is definitely room for all; and, in some cases, room for competition. Consumers like a purchase that is good value but also like to feel as though they’ve supported a ‘small’ or ‘local’ firm, and this is often overlooked when it comes to setting up afresh, or expanding, online.

The findings from the survey indicate that consumers are looking to find and build trust in online shopping brands – but what makes customers actually take the plunge, enter their details and hit the ‘Buy now’ button? It turns out that trust isn’t the biggest factor in a final purchase decision – but rather, price – 82% of consumers named it as their first priority. This isn’t to say necessarily that the cheapest option is the purchase default for all, but that online shoppers will pay for perceived value in a product and need to consider the price point to be fair and appropriate. What’s more, their decision isn’t just influenced by the product price alone – 63% of online shoppers from the Feefo survey said that they had abandoned their cart at the checkout stage when shipping or postage costs are considered to be too expensive. Resolving this issue takes just a ‘quick fix’; remaining concise and transparent about delivery costs and options before the checkout process begins, and keeping this messaging prominent enough on the site that it can be easily found.

Keeping consumers engaged right through the checkout process is clearly important: but anyone who has shopped online at multiple retailers will tell you that the experience barely varies between brands. The simplest way to stimulate a rapid purchase with the least effort and interaction required is to have customer payment details stored and available for immediate recall, but this usually requires a purchase to have already been made and for the customer to elect specifically for their details to be recorded and stored securely. This doesn’t, however, account for those who choose to leave the checkout purely through indecisiveness, or if they’re unable to successfully apply an expected discount code. The latter can be covered off with comprehensive and clear communication elsewhere on the website, but the former is more difficult to tackle.

62% of those surveyed believe that the decision-making process to make a purchase that they go through online is more balanced, cautious and conservative than it would be in a high street store. The trust online retailers are able to nurture depends largely on their target audience. Those catering for older audiences may find it difficult to encourage online retail of any type, whereas those selling technology products and services or aiming toward a younger audience are easily able to convert a visitor to a sale (or an appropriate call to action, as required). Whilst the exact reason for more cautious decision-making online isn’t specifically identified (and indeed could vary from person to person), the inability to be able to physically see and touch the product is likely to contribute – many of us still have to see something to believe it!

Only 4% of the survey respondents believed that their buying decisions online were impacted by global issues such as concern for the environment, although this is expected to be on a growing trajectory and such issues are increasingly being catered for by businesses of all types, shapes and sizes. Whilst this may seem as though it makes increased business focus on corporate social responsibility initiatives and increasingly environmentally-aware processes redundant, it should be noted that, of course, companies should continue to focus on these areas even if just to continue sustainably. There is certainly increasing consumer consideration on such topics, even if they’re not yet influencing purchases – although, during 2025, the reasons for this may be varied and indeed even temporary as a result of the tumultuous current climate.

No matter the perks of the product or service, price remains key – and value, king.