Online loans are fast becoming one of the most popular ways to obtain credit. And it is easy to see why – the application process is easier than ever, comparing products is as simple as swiping across your phone to find the best deal and the money is paid into account (generally) very quickly… but is this a good or a bad thing? Like all interesting questions this is impossible to answer in black and white; It all comes down to context. Today the context we’re viewing this is the emerging economy of South Africa.

A South African survey (Old Mutual Savings and Investment Monitor) showed that 52% of respondents stated they have had to use savings to make ends meet. This is more than double the number (23%) who had to access savings last year. Of course, the coronavirus crisis has made financial troubles worsen over the past year. No one really expected this virus to hit the world’s economies like it did, and each household has been affected. Some people have lost jobs or had their hours reduced, meaning that there is a real shortfall in money in the household to help make ends meet.

The study also showed that many people sought some form of debt relief in the past year. This includes:

- People with loans from a friend or family member (41% of people with this type of loan sought payment holidays or debt relief)

- People with loans from a micro lender or mashonisa (40%)

- People with online loans (38%)

- People with home loans (35%)

- People with credit cards (29%)

- People with store cards (25%)

With this in mind, it seems like online loans are becoming an option for many people because of the financial crisis and the coronavirus effects. Those households that were particularly struggling with low income before the crisis are likely to be finding it even harder now.

Being able to use credit is a Godsend for many. It can really help when times are tough and you simply can’t afford certain unexpected bills. However, choosing to apply for any kind of loan should only be done after a lot of thought and consideration. You should not rush the process, because not only may you end up with the wrong product, but you could worsen your financial situation and spiral deeper into debt. Loans have their place – so knowing when to utilise them is vital.

The Good & The Bad Reasons

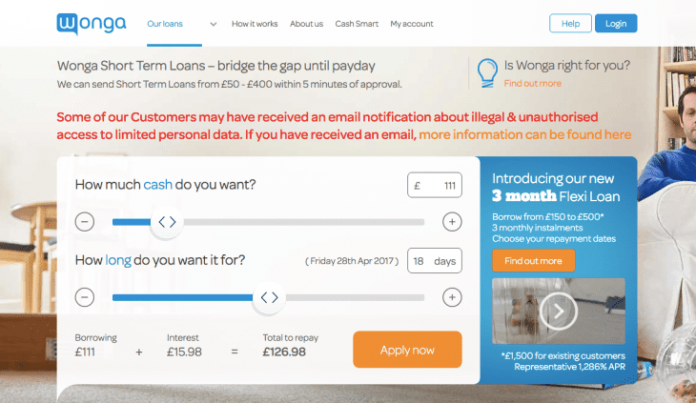

The dominant online loan company of the African continent (Wonga) have gone to great lengths to explain that there are good reasons and bad reasons for taking out loans, and one should familiarise themself with the reasoning and the thought behind this theory.

For example, a good reason would be when it will ultimately benefit your financial situation in the long run. If you want to pay for tuition fees using a loan, this could be classed as a good reason because it means that you might well qualify for that job that you want that pays extra salary, or it may open up more opportunities for you in the future.

A bad reason might be to spend on clothes or accessories which you don’t really need. You may have a shopping habit that you cannot control, if that is the case. Remember that everything you borrow needs paying back and then some, so, using Wonga’s theory, you need to consider your reasons for taking out the loan before applying.

Wonga’s desire to inform and educate the South African populus had led to the development of a dedicated learning hub called ‘The Money Academy’ filled with further insights and educational videos, all free of charge for anyone to use.

Further ‘good reasons’ include home improvements, debt consolidation or covering an unexpected utility bill that really needs paying. As everyone’s unique situation is exactly that – unique, it is vital that you properly consider your options and understand the full terms of the loan, so you know what you are signing up for.

The Application Process

You might think the application process is easier than in the past – traditional loans would require reams of paperwork and conversations with bank managers. However, you can now do it all online wearing your pyjamas at any time of the day or night! Yes, this is easier for many, but this shouldn’t distract from how important the application process still is. You need to ensure you read all the wording carefully. If you are unsure of anything, call the company to ask them to explain it. Any reputable company will indeed break it down for you to enable you to understand it more. That’s another point, actually – using a reputable company. Lenders who are fully insured are the only sure fire way of getting a reputable loan and allow you (and them) to be covered by the law and regulating body. Loan sharks (locally known as mashonisas) are not worth the risk and can cause more stress than good.

Receiving the Money

When your application does go through and you receive the money, it should literally be within a few days that it will show in your bank account. Use the money wisely – especially during this difficult financial time – and remember what you applied for the money for in the first place! It can be all too easy to splash the cash when you see all that money but realistically, it all needs paying back and you need to maintain control of your finances.

When You Can’t Repay

Sometimes debt gets on top of us and you find yourself slipping down the spiral with little control over your life. This can cause extreme stress, sleeplessness and anxiety. If you find yourself becoming like this, it is a good idea to speak with a financial expert. This person will not judge your situation and will be able to look at your case to see if there is a way of reducing your debts in a legal and fair way, to take the pressure off. This can be a welcome relief for many and there are many debt charities in South Africa who will be pleased to help you with this.