LinkedIn Corp (NYSE:LNKD), the largest professional social network worldwide disappointed investors despite reporting a 47% increase in revenue for the fourth quarter as it was overshadowed by its weak revenue outlook for the quarter. As a result, the shares of the company plummeted $18.95 per share or more than 8% to $204.50 per share.

During the fourth quarter, the professional social network said its non-GAAP net income went up to $48.2 million from $40.2 million while its non-GAAP earnings per share increased to $0.39 from $0.35 per share in the same period a year earlier.

Business outlook

Corp (NYSE:LNKD) anticipated that its revenue for the first quarter of 2014 will be in the range of $455 million to $460 million and adjusted EBITDA at around $106 million to $108 million. The revenue guidance provided by LinkedIn Corp (NYSE:LNKD) is lower than the consensus estimate of Wall Street analysts of $470 million.

For the full year 2014, LinkedIn Corp (NYSE:LNKD) projected that it will be able to deliver revenue around $2.02 billion to $2.05 billion and adjusted EBITDA of about $490 million. Its revenue guidance for the entire year is also less than the consensus estimate of $2.16 billion.

The lower-than-expected revenue outlook of the professional social network is perceived by investors as an indication that it is facing challenges in maintaining its growth in the future.

LinkedIn buys Bright

According to the company, it will execute aggressive investments for to improve both member and customer platforms. Jeff Weiner, CEO of LinkedIn Corp (NYSE:LNKD) said, “Solid fourth quarter performance capped another successful year where improvements in scale and relevance across our platform led to strong member engagement. Moving forward, we are investing significantly in a focused number of long-term initiatives that will allow us to realize our vision to create economic opportunity for every member of the global workforce.”

The company also announced that it is acquiring Bright, a company engaged in using data insights and matching technology to connect prospective talents and employers for $120 million. The acquisition price is subject to adjustment and will composed of 27% cash and 73% stock.

“What LinkedIn does best is connect talent with opportunity at massive scale by leveraging Bright’s data-driven matching technology, machine-learning algorithms and domain expertise, we can accelerate our efforts and build out the Economic Graph,” said Deep Nishar, SVP of Products and User Experience.

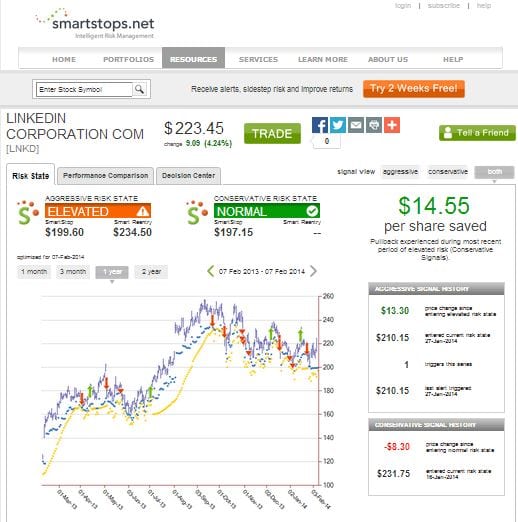

Equity risk state

Smartstops.net, an investment risk monitoring firm with a team of market technicians expert in exit strategies using risk management algorithms indicated that LinkedIn Corp entered a risk state in January 27 when the stock started trading at $210.15 per share. Investors who pulled out their position at that time saved $14.55 per share.