King Digital Entertainment, the maker of the popular mobile game Candy Crush Saga set its initial public offering (IPO) price at $22.50 per share, according report from New York Times’ DealBook. The company will be trading at New York Stock Exchange (NYSE) under the ticker symbol “KING.”

The offering price was the mid-point of its proposed price range of $21 to $24 a share based on its regulatory filing. King Digital is aiming for a $7.6 billion valuation. The company’s intended offering price of $22.50 a share will still give the company a valuation of around $7 billion.

The Challenge confronting King

One of the challenges confronting King Digital is the trend or reality that regardless of the popularity of a particular mobile game, user engagement will decline over time. Users are constantly looking for more exciting and interesting games. Take note that the popularity of smash hit games like Angry Birds and Farmville developed by Rovio Entertainment and Zynga Inc (NASDAQ:ZNGA) respectively declined over time.

King Digital’s most successful mobile game is the Candy Crush Saga with 96 million daily active users (DAUs) and 1.06 billion daily game plays. The mobile game managed to keep users playing and helped the company increase its profit substantially to nearly $568 million last year from $1.3 million losses in 2011

DealBook noted that Candy Crush Saga is not exempted in the trend as its gross booking fell in the fourth quarter. Gross booking is the non-standard measure of how much users pay for virtual items and other goodies in a game.

Hoping to avoid Zynga’s fate

King Digital needs to prove to investors that it has the ability to develop smash hit games in the future to avoid experiencing the current situation of Zynga Inc (NASDAQ:ZNGA). During the peak of the popularity of Farmville, Zynga’s stock went high and the company’s valuation reached as much as $10 billion in 2012. However, when it failed to develop other compelling games and shift to mobile platform, its stock price nose dive.

Mark Little, an analyst at Ovum, a technology consulting firm in London said, “Companies like King are reliant on hits. It’s an open question whether they can sustain their success.”

King Digital is hoping to avoid the fate of Zynga Inc (NASDAQ:ZNGA) by focusing on developing mobile games and encouraging users to link its games to their accounts on Facebook Inc (NASDAQ:FB) to maintain user engagement.

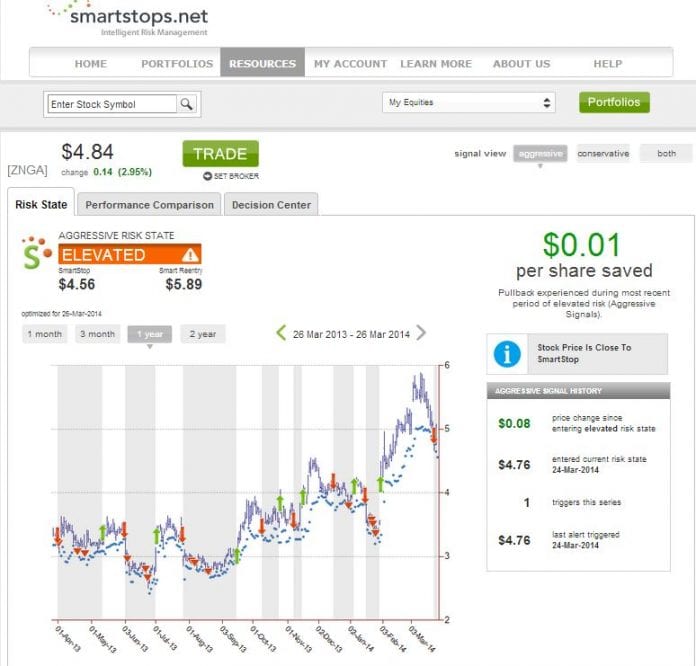

It is interesting to note that stock price of Zynga Inc (NASDAQ:ZNGA) climbed almost 3% to $4.84 per share today prior to King Digital’s IPO on Wednesday. Smartstops.net, a stock market risk management firm shows that the shares of Zynga are remain at an elevated risk. Its current stock price is still far below its offering price in 2011.

Some investors are encouraged to invest in the company because the stock is cheap, and its CEO Don Mattrick is confident that 2014 is a year of growth for Zynga Inc (NASDAQ:ZNGA). The company showed improvement in its fourth quarter financial results released last January.

Any investment is accompanied by risk and investors are aware of that. Smart investors protect themselves from suffering losses by constantly monitoring their investments using different risk management solutions.Investors planning to invest in King Digital, Zynga or any company should try Smartstops.net. The firm’s risk management algorithms are a product of more than 40 years of stock market experience. Its proprietary analysis produces a risk price point that can be used proactively in the next day’s market or the service will alert you in real-time to an “elevated” risk state indicating a high probability of a continued decline in the equity’s price.