America was taken by storm when the first credit cards were introduced back in 1950. It presented the opportunity for consumers to purchase new products without putting money upfront in the traditional form of cash. Payments using non-cash has long been dominated by the Big Four credit card issuing firms: Visa Inc (NYSE:V), Mastercard Inc (NYSE:MA), Discover Financial Services (NYSE:DFS), and American Express Company (NYSE:AXP). Anyone who has a bank account and has a debit or credit card knows these brands and how they work.

While these four still dominate the market for payment method, other companies are starting to work an alternative method of payment. It can stated that this revolution began with the formation of Paypal. Now owned by eBay Inc (NASDAQ:EBAY), Paypal allowed consumers to pay and receive funds via internet. Now new start up firms like Square, have taken the idea to a new level. Square allows customers to pay pre-approved merchants instantly. However, where Square has evolved from Paypal, merchants no longer have to wait several days for their funds and often times be receiving their revenues in just 2 or 3 business days. Additionally, big retailers are starting to catch on and accept payments from services like Square, the struggling Google Wallet, Paypal, Visa and Mastercard’s fast payment services, etc.

Research firm Gartner, estimated that mobile payments through services like Paypal came in around $235.4 billion in 2013. Additionally, the firm says that mobile payments will likely see 35% annual growth figures until 2017, where it is estimated that $781.8 billion will exchange hands over mobile payments. This highlights the significant growth and desire for firms to get a piece of the pie.

Apple Inc. (NASDAQ:AAPL) is one such company that is plotting its run at mobile payments. While other competitors have struggled to catch on for consumers and retailers alike, that could be changing shortly. A January 16th patent from Apple titled “Method To Send Payment Data Through Various Air Interfaces Without Compromising Data”. Putting the pieces together, we know that Apple supports the use of Bluetooth enabled sensors called iBeacons. The beacons would be placed in a retail store and your phone syncs up to the beacons and allows the business to have a customer’s bill up on the POS system, allowing the business to charge the balance to the customer’s mobile payment option.

Apple CEO Tim Cook recognizes the opportunity and had this to say on Apple’s last earnings call: “looking at the demographics of our customers and the amount of commerce that goes through iOS devices versus the competition that it’s a big opportunity on the platform”. When thinking of the company’s app store, iTunes, etc, there are a lot of credit cards already uploaded and synced to Apple accounts. In addition, the company’s new interest in beefed up security, as seen through the Tough Id, highlights the need for those services in order to have a safe and secure mobile payment program. For Apple, all the pieces to the puzzle are in place and it is just time the company made a formidable platform that would draw customers. As seen through research at Gartner, the growth potential is huge and Apple is in a prime spot to be the eventual leader of the industry.

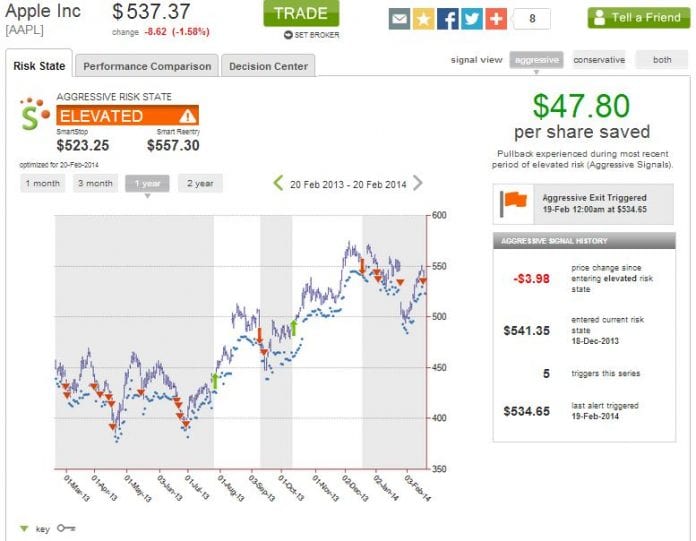

While Apple investors certainly have some long term catalysts, it is important to take action to protect your positions during periods of elevated risk. This is where services like SmartStops comes into play. The risk management service alerts subscribers of periods where risk is heightened so that investors can protect their profits or limit losses if they’ve entered to soon.

Back in late October 2012, Apple stock was at $700 and SmartStops alerted investors that the stock was facing increased risk. SmartStops again alerted investors that risk was elevated in early January 2013 when the stock was at $500. The stock went on to fall to $400 in the next few months. Investors that chose to hedge or exit their positions during the first alert saved $300 per share.

Source: SmartStops

The bottom line is that the mobile payment industry is set to take off. Apple has the pieces of the puzzle to have a successful entry into the mobile payment world. With already huge number of customers purchasing items through its iOS devices already, it would not be hard for Apple to pitch its new product. In addition, the beacon systems that are located in retail environments are relatively cheap and are in supply. Lastly, Apple has been working on its Touch Id security software and based on hints from the company, will evolve into a more security-based service for consumers using their devices to make mobile payments. Investors have a lot of bullish news to take in, but that must not take over proper risk management techniques that could save you from major losses.