The shares of Herbalife Ltd (NYSE:HLF), the controversial multilevel marketing (MLM) company that sells nutritional and weight loss products surged more than 7% to $69.02 per share, but pulled back nearly one 1% during the extended hours trading on Monday to $68.35 per share.

Earnings guidance/shares buy back

The positive momentum in the stock price of Herbalife Ltd (NYSE:HLF) was primarily driven by its better-than-expected earnings and revenue estimates for the first quarter of 2014.

The company projected that it will be able to deliver earnings in the range of $1.24 to $1.28 per share despite an estimated negative impact of foreign currency exchange rate of $0.20.

The stock was also lifted by the decision of the board of directors of Herbalife Ltd (NYSE:HLF) to increase its shares repurchase program by $500 million to $1.5 billion. According to the company, it has $653 million balance from its previous $1 billion share repurchase authorization

Preliminary financial results

Based on the preliminary financial results released by Herbalife Ltd (NYSE:HLF), its diluted earnings per share are expected to be in the range of $1.13 to $1.17 per share in the fourth quarter. The company reported $1.00 diluted earnings per share in the year-ago quarter. In terms of revenue, the company estimated an increase of approximately 18.5% for the quarter.

For the full year 2013, the company estimated that it will be able to generate $4.89 to $4.93 diluted earnings per share and a 19.8% increase in sales. In 2012, Herbalife Ltd (NYSE:HLF) reported $3.94 earnings per share.

Calls for investigation

In December 2012, activist investor, Bill Ackman alleged that Herbalife Ltd (NYSE:HLF) is a pyramid scheme and he disclose his huge short position in the company. Several prominent activist investors such as Carl Icahn refuted Ackman’s claim and initiated a large long-position in the company. Since then, the company became the center of media coverage. Many consumer activist groups particularly from the Latino community believed that the company’s business practices are deceitful, and called regulators to investigate it.

The New York Post reported that that Federal Trade Commission (FTC) Chairperson, Edith Ramirez will meet with the League of United Latin American Citizens (LULAC) regarding their complaints against Herbalife Ltd (NYSE:HLF), one week after Democratic Sen. Edward Markey urged the agency to look into the matter. Prior to that, LULAC met with the staff members of the CA Attorney General Office regarding the issue. Herbalife Ltd (NYSELHLF) strongly denied the accusations against.

When regulators in China started an investigation against Nu Skin Enterprises (NYSE:NUS), a similar multi-level marketing company, the stock price of Herbalife Ltd (NYSE:HLF) plummeted 10%. Investors were concern that Herbalife might become the next target of such investigation. When Sen. Markey called for an investigation, Herbalife shares plunged 12%.

Despite the controversies and calls for investigation, TheStreet Ratings team recommends a Buy rating for the shares of Herbalife Ltd (NYSE:HLF) citing several factors such as its robust revenue growth, solid stock price performance, and earning per share growth.

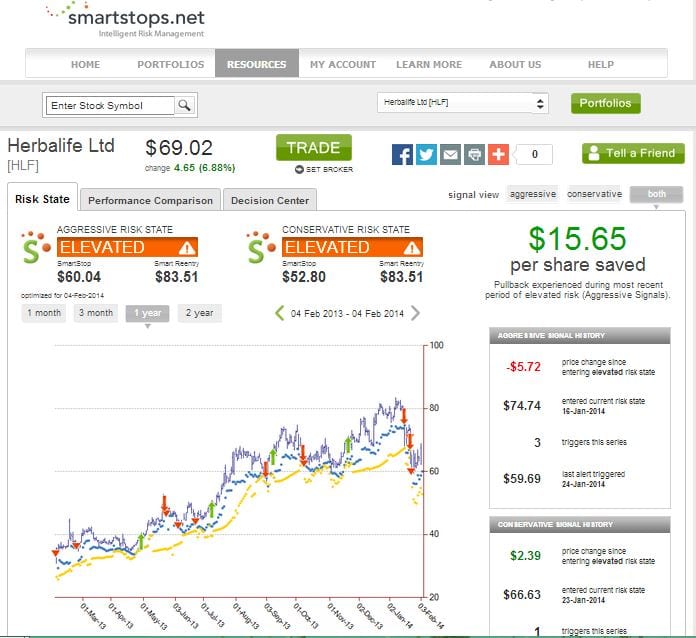

Smartstops.net’s risk management algorithms indicated that Herbalife Ltd (NYSE:HLF) has an elevated risk level, which was triggered when the stock started trading around $74.74 on January 16.