Consumer adoption of Apple Inc. (NASDAQ:AAPL)’s Apple Pay continues, but the rate of adoption is slower than was previously noticed, according to findings by Phoenix Marketing International. It has also emerged from the Phoenix report that Gen X are more receptive to Apple Pay than the millennials. Currently, Apple Pay is only available in the U.S. and the U.K.

The uptake of Apple Inc. (NASDAQ:AAPL)’s Apple Pay by consumers is going on, but Phoenix has established that the rate at which households are signing up for the service has cooled. Phoenix says that 14% of credit card holders in the U.S. had signed up for Apple Pay as of the end of September. That was an increase from 11% in February. Apple Pay was launched in October 2014.

According to Phoenix’s researcher Greg Weed, consumer uptake of Apple Pay was initially rapid, but has slowed down a year later. Apple earlier this month stated that Apple Pay monthly transactions have increased at double digits since the service launched.

For the one year that Apple Pay has been around, its adoption is higher among Gen X (those in the age bracket of mid-30s to mid-50s). About 48% of Gen X use Apple Pay compared to 42% of millennials (those aged between 21 and 34).

Card usage

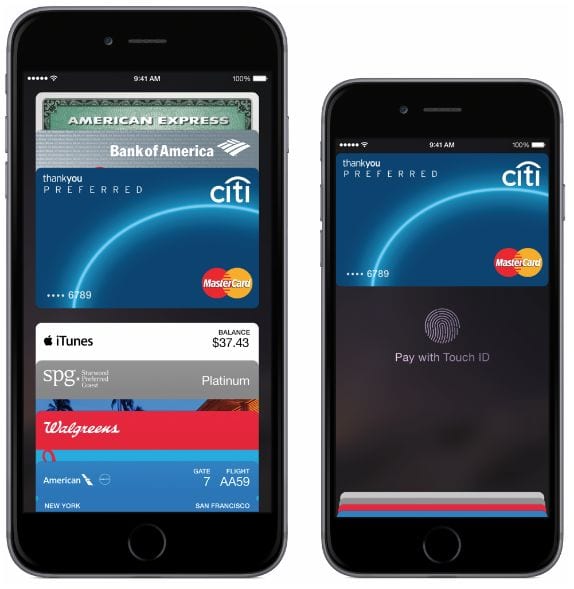

Phoenix’s findings also show that 86% of Apple Inc. (NASDAQ:AAPL)’s Apple Pay users have tied the service to their credit cards for purchases while 49% have linked the service to their debit cards. Another 22% of Apple Pay subscribers use other types of prepaid payment cards.

Phoenix derived its findings from tracking 15,000 consumers who use Apple Pay.

Store adoption

Apple Inc. (NASDAQ:AAPL) has also continued to win over merchants to Apple Pay. The company recently announced adding 75 U.S. bank-partners to Apple Pay network. Availability of Apple Pay services is currently restricted to the U.S. and the U.K., but Apple is planning more international rollout of the service with Canada being part of the immediate plan.

Sources: reuters