The stock price of Apple Inc. (NASDAQ:AAPL) surged almost 8% to $565.19 per share after reporting better-than-expected earnings for its fiscal second quarter, and boosted its shares buyback until the end 2015.

Financial results

Apple Inc (NASDAQ:AAPL) reported a net profit of $10.2 billion or $11.62 earnings per diluted share on $45.6 billion revenue for its second quarter that ended March 29, 2014. During the year-ago quarter, the iPhone and iPad maker delivered $9.5 billion profit or $10.09 diluted earnings per share on $43.6 billion revenue.

The earnings results of the Cupertino-based technology giant outperformed the $10.18 earnings per share on $43.53 billion revenue forecasted by Wall Street analysts for its fiscal second quarter.

In a statement, Apple CEO Tim Cook said, “We’re very proud of our quarterly results, especially our strong iPhone sales and record revenue from services. We’re really eagerly looking forward to introducing more new products and services that only Apple could bring to market.”

Apple Inc. (NASDAQ:AAPL) shipped 43.72 million iPhones, 16.35 million iPads, 2.76 million iPods, and 4.14 million Mac computers during the period. The tech giant outperformed the expected iPhone and iPad shipments of analysts at 37 million and 19 million, respectively.

During the quarter, Apple Inc (NASDAQ:AAPL) said its gross margin increased from 37.5% last year to 39.3%.

Shares buyback/Quarterly dividend

Apple’s CFO Peter Oppenheimer said the company generated $13.5 billion in cash flow and returned $21 billion capital to shareholders through dividend payment and shares buyback during the period. According to him, “That brings cumulative payments under our capital return program to $66 billion.”

The board of directors of directors of Apple Inc. (NASDAQ:AAPL) approved additional $30 billion shares buyback to $90 billion until the end of 2015, and a seven-for-one stock split. In addition, the company also approved an approximately 8% increase in quarterly dividend to $3.29 per share, which will be payable on May 15 to shareholders of record on May 12.

Outlook

For its June quarter, Apple Inc. (NASDAQ:AAPL) expected to deliver revenue in the range of $36 billion to $38 billion and gross margin between 37% and 38%. The company also estimated that it will incur around $4.4 billion to $4.5 billion operating expenses. Its tax rate is expected to be around 26.1%.

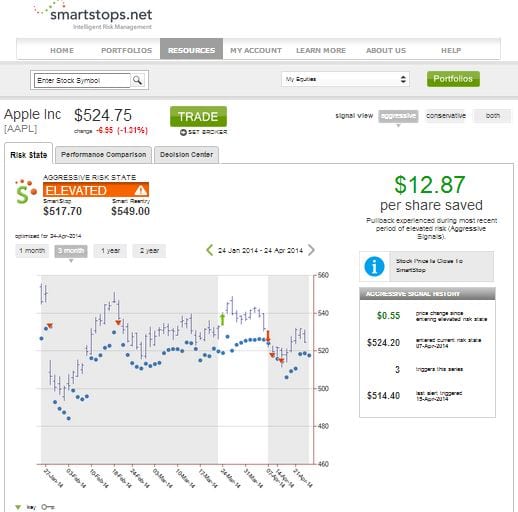

Equity risk

Smartstops.net, an equity risk management firm shows that the shares of Apple Inc. (NASDAQ:AAPL) remained at an elevated risk state. The company’s stock entered its current risk state when it went down to $524.20 a share on April 7. Investors who exited their investment in the stock during its most recent state of elevated risk state saved $12.87 per share.