Apple Inc. (NASDAQ:AAPL), the world’s company by market capitalization, may face more than $8 billion tax bill in connection with the investigation of the European Commission regarding its tax policies, according to Bloomberg.

Matt Larson, a litigation analyst Bloomberg Intelligence analyzed the European Commission’s investigation against Apple, which was accused of tax avoidance.

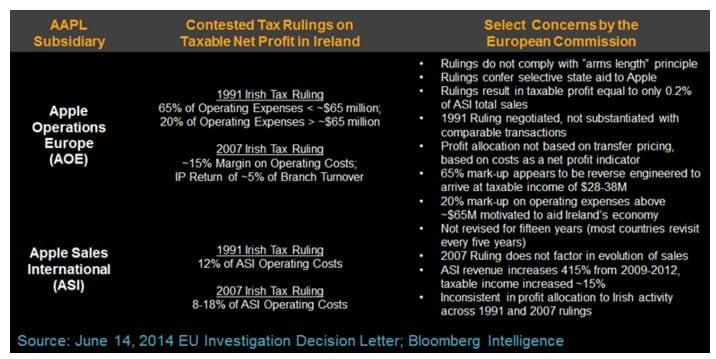

The European Commission started investigating Apple’s tax avoidance strategy known as “Double Irish” in June 2014. The European Commission alleged that the iPhone maker is using its subsidiaries in Ireland to avoid paying significant taxes.

Its inquiry aims to determine whether Apple’s tax deals with Ireland are considered illegal state aid/ a selective advantage to reduce its tax liabilities below the appropriate rate. Apple managed negotiated a special corporate tax of less than 2% in Ireland compared to 35% corporate tax rate in the United States.

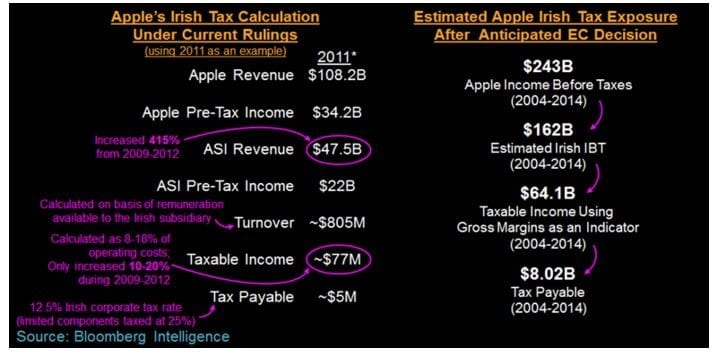

According to Bloomberg, Apple may be required to pay more taxes at a rate of 12.5% on its $54.1 billion profit generated from 2004 to 2012.

If the Commission decides to enforce a tougher accounting standard, Apple may owe taxes at a 12.5 percent rate, on $64.1 billion in profit generated from 2004 to 2012, according to Larson.

Apple repeatedly denied the allegations

In 2014, Apple stated that it is paying every euro of every tax it owes. The tech giant also said, “We have received no selective treatment from Irish officials. Apple is subject to the same tax laws as scores of other international companies doing business in Ireland.”

During a recent interview on CBS Corporation’s “60 Minutes,” Apple CEO Tim Cook denied that the company practices tax avoidance. He described the criticism against the iPhone maker as a “political crap.” He added that a tax reform is necessary because the tax system is outdated.

Apple stated in its financial statement for 2015 that the investigation of its taxes is a risk factor to investors. Aside from the European Commission, the United States Internal Revenue Services (IRS) is also examining its tax returns. According to the tech giant, if its tax rate will changes, its “financial conditions, operating results, and cash flows could be adversely affected.

The European Commission is expected to release a decision regarding its investigation on Apple’s taxes as early as March this year. The tech giant said it would appeal any unfavorable ruling against it.