Apple Inc. (NASDAQ:AAPL) is engaged in discussions to acquire a Japanese company engaged in the design, development, manufacture, sales, and marketing of LCD drivers and controllers for small and mid-size LCD panels.

According to Nikkei, Apple Inc. (NASDAQ:AAPL) is negotiating with Renesas Electronics Corporation (TYO:6723) to acquire its entire 55% stake in its joint venture, Renesas SP Drivers for ¥50 billion ($479 million). Sharp Corporation (TYO:6753) and Taiwan’s PowerchipGR holds 25% and 20% respectively in the joint venture

The report indicated that Sharp Corporation (TYO:6753) is willing to sell all of its stake in Renesas SP Drivers to the iPhone and iPad maker wants to pursue such transaction after it succeeds in reaching an agreement with Renesas Electronics Corporation (TYO:6723) to buy out all of its shares. Apple Inc. (NASDAQ:AAPL) is expected to seal a deal by summer this year, and retain the employees of the Japanese chip maker.

Apple Inc. (NASDAQ:AAPL) obtains all of its LCD chips for the iPhone from Renesas SP Drivers. The chips determine the quality and performance of the display and the overall energy efficiency of a smartphone. The Japanese chipmaker accounts approximately one-third of the LCD market share.

Technology observers suggests that the iPhone maker’s acquisition of Renesas SP Drivers will allow it to bring the design of core LCD components to incorporate it with its overall product development given the importance of image quality to strengthen its competitiveness in the smartphone market.

A report from Strategy Analytics showed that global smartphone market share of Apple Inc. (NASDAQ:AAPL) declined by 4.4% to 17.6% the fourth quarter, last year. Its number competitors, Samsung Electronics Co. Ltd (KRX:005935) gained 0.6% to 29.6%.

Strategy Analytics Executive Director, Neil Mawston noted, “Apple grew a sluggish 13 percent annually and shipped 153.4 million smartphones worldwide for 15 percent market share in 2013, dipping from the 19 percent level recorded in 2012.”

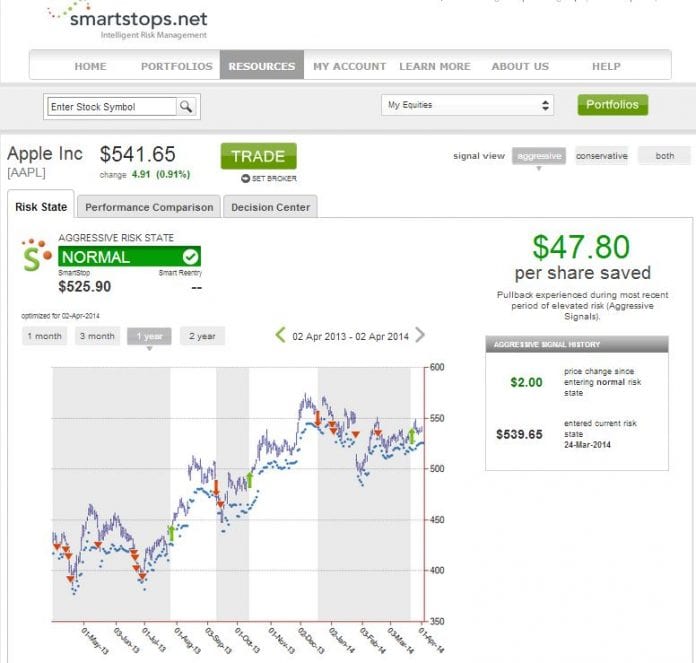

The stock price of Apple Inc. (NASDAQ:AAPL) closed at $541.65 per share, up by nearly 1% on Tuesday. Over the past 52-week range, the shares of the company rose from $385.10 to $575.14 a share.

Smartstops.net, a stock market risk management firm shows that the equities of Apple Inc. (NASDAQ:AAPL) are currently at a normal risk level. Investors who received a risk alert from the firm during its most recent period of elevated risk and pulled back their investments saved $47.80 a share.