AT&T Inc. (NYSE:T) announced that its board of directors approved a 300 million shares buyback program, which represents approximately 6% of the outstanding shares of common stock of the company.

The total amount of the stock repurchase program is approximately $10.5 billion based on the closing price of the shares of AT&T Inc (NYSE:T) on Friday. The stock closed at $35.07 per share today.

In a statement, Randall Stephenson, chairman and CEO of AT&T Inc (NYSE:T) said, “The board’s authorization reaffirms our confidence in the strength of the business and our commitment to returning value to our shareholders while investing in our networks and operations.”

The telecommunications company bought back 175 million shares under its March 2013 shares authorization program. AT&T Inc (NYSE:T) already repurchased total of 775 million of its own shares since it started its repurchase program in 2012.

No immediate impact on AT&T’s debt ratings

Moody’s Investors Services said the 300 million shares buyback authorization announced by AT&T Inc (NYSE:T) has no immediate impact on its A3 senior unsecured long-term debt and Prime-2 short-term debt ratings or the stable outlook.

The ratings agency believed that the telecommunications company is capable of sustaining its current pace of shares buyback based on its level of activity since June 30 last year. Moody’s also believed that AT&T Inc (NYSE:T) will be able to meet its ongoing investment requirements, and assumed that it will continue to monetize non-core assets including its stake in America Movil.

AT&T board declared dividend

Last Friday, the board of directors of AT&T Inc (NYSE:T) also approved a quarterly dividend payment of $0.46 per share on its common stock. The dividend will be distributed on May 1 to stockholders on record at the end of the business on April 10.

AT&T completes acquisition of Leap Wireless

Early this month, AT&T Inc (NYSE:T) completed its acquisition of Leap Wireless International Inc (NASDAQ:LEAP) for $15 per share in cash, and it will integrate the Cricket brand to its existing operations. AT&T will create a new Cricket brand to shake up to shake-up the no-contract segment with simple, low-cost rate plans.

Equity Risk

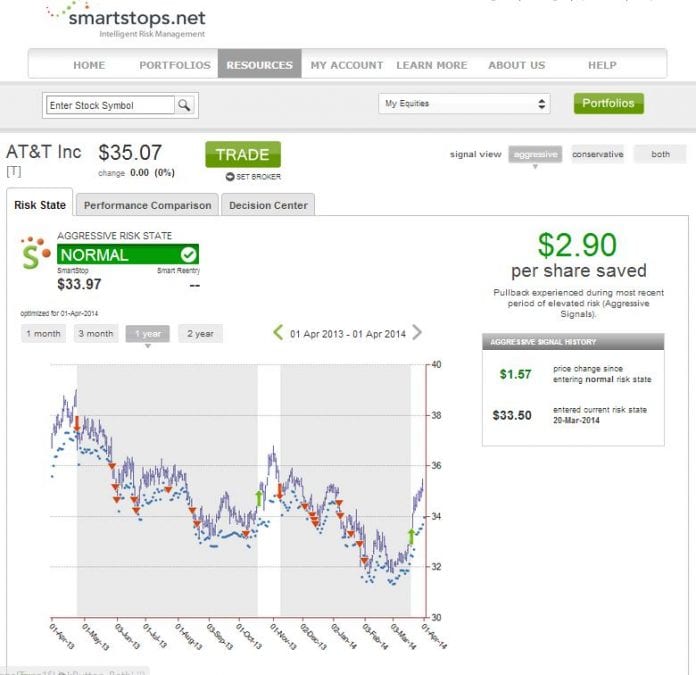

The shared of AT&T Inc (NYSE:T) are currently at a normal risk level, according to Smartstops.net, an equity risk management firm that provides risk price points that can be used by investors in the next day’s trading. The firm also sends risk alerts to its members in real-time when a stock in their portfolio hit an elevated risk level.

Investors who pulled back their investment in AT&T Inc (NYSE:T) when they received an alert during its most recent state of elevated risk saved $2.90 a share.