The stock price of Oracle Corporation (NYSE:ORCL) closed at $38.84 per share, up by over 1%. However, those gains vanished and its shares plummeted 3.45% to $37.40 a share during the extended trading hours after the company reported disappointing financial results for its fiscal third quarter financial results.

Financial results

Oracle Corporation (NYSE:ORCL) said its earnings rose 8% to $0.56 per share or $0.68 per share on non-GAAP basis. Its revenue rose 4% to $9.31 billion. The financial results of the company missed the $0.70 earnings per share on $9.36 billion estimated by Wall Street analysts.

The company reported that its new software licenses and cloud software subscription climbed 4% to $4.2 billion. Revenues from software license updates and product support went up by 5% to $4.6 billion. The company’s hardware systems products posted $725 million revenue, an increase of 8%.

On GAAP basis, Oracle Corporation (NYSE:ORCL) recorded a 7% increase in operating income and 38% operating margin. Its net income rose increased 2% to $2.6 billion. The company’s operating cash flow rose 10% to $15 billion on a trailing twelve-month basis.

Executives say Oracle businesses achieve strong growth

In a statement, Mark Hurd, president of Oracle Corporation (NYSE:ORCL) emphasized that sales of Oracle’s Cloud Applications significantly increase with more than 60% bookings growth during the quarter.

According to Hurd, “Our quarterly Cloud Application revenue is now approaching $300 million. All of our strategic Cloud Application Suites, including Fusion Enterprise Resource Planning, Fusion Human Capital Management and Fusion Customer Experience, posted triple-digit revenue growth.”

On the other hand, Oracle CEO Larry Ellison pointed out that the company’s Engineered Server Systems including Exadata and SPARC SuperClusters generated more than 30% constant currency growth rate during the period. He noted that the entire industry’s traditional high-end server product lines suffered steep declines.

“Our Engineered Systems business is growing rapidly for the same fundamental reason that our Cloud Applications business is growing rapidly. In both cases, customers want us to integrate the hardware and software and make it work together, so they don’t have to,” said Ellison.

Board of directors approve dividend

The board of directors of Oracle Corporation (NYSE:ORCL) approved a dividend payment of $0.12 per share to shareholders of record by the end of the business day on April 8. The company will distribute the dividend on April 29.

Equity risk

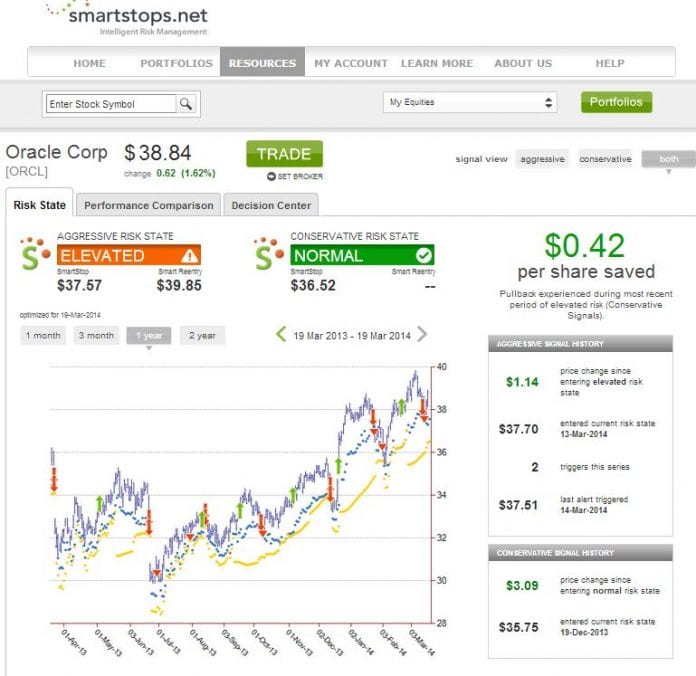

Given the decline in the stock price of Oracle Corporation (NYSE:ORCL) due to lower-than-expected earnings results, some investors are wondering about the risk associated with the stock. Smartstops.net, a stock market risk management firm shows that the shares of the company entered an elevated risk level (aggressive signals).

Smartstop.net’s risk management algorithms are a product of more than 40 years of stock market experience. Its proprietary analysis produces a risk price point that can be used proactively in the next day’s market or the service will alert you in real-time to an “elevated” risk state indicating a high probability of a continued decline in the equity’s price.