The stock price of Yahoo! Inc. (NASDAQ:YHOO) jumped 4% to $39.11 per share after Alibaba Group Holding Ltd disclosed that it started the process for an initial public offering (IPO) in the United States on Monday.

Yahoo! Inc. (NASDAQ:YHOO) owns 24% of Alibaba. Investment banks estimated that the market value of the Chinese e-commerce company is approximately $200 billion. Alibaba Group Holding Ltd decided to list its shares in the United States after experiencing difficulties in getting approval for its proposed governance structure from Hong Kong regulators, according to Bloomberg.

Commenting on its planned U.S. IPO, Duncan Clark, chairman of BDA China Ltd said, “The U.S. has obvious advantages in terms of the depth of the pool of capital and sophistication of the investor base…It seems that the Hong Kong stock exchange wasn’t able to accommodate.”

U.S. IPO will make Alibaba more global

In a statement, Alibaba group Holding Ltd said that the IPO will make the company more global and it will enhance its transparency. The company added, “Should circumstances permit in the future, we will be constructive toward extending our public status in the China capital market.”

The proposed Alibaba IPO will probably the biggest since the IPO of Facebook Inc (NASDAQ:IPO) in 2012. The Chinese e-commerce company has not yet chosen which of the U.S. exchanges, when to list its stock, and how much it intends to raise from the public offering, according to a person familiar with the issue. Some analysts suggest that Alibaba could raise $15 billion to $16 billion from the public offering.

Yahoo’s stock price doubled due to stake in Alibaba

A separate report from CNBC noted the shares of Yahoo! Inc. (NASDAQ:YHOO) doubled since Marissa Mayer joined the company as chief executive officer in 2012. According to Trip Chowdhry, managing director of Global Equities Research, the growth of the company was mainly due to its 24% stake in Alibaba.

“We need to give credit where credit is due and that is Yahoo’s stake in Alibaba. When Alibaba goes public the company will get some more money, but from the fundamental point of view investors should ask has Marissa Mayer really improved Yahoo? And I would say not at all,” said Chowdhry.

Analyst advice investors to be cautious investing in Yahoo

On the other hand, Collin Gillis, a senior technology analyst and director of research at BGC Capital advised investors to be cautious in making an investment on the shares of Yahoo! Inc. (NASDAQ:YHOO). He said. “If you are investing in Yahoo for the Alibaba payoff you may want to be careful. Investors should be asking, ‘will I get to see this cash?”

Gillis suggested three possible things Yahoo! Inc. (NASDAQ:YHOO) might do including a one-time dividend payment, increase its shares buyback, or spend cash on acquisitions. According to him, the last two options is more likely.

“The first step with this asset is to turn it into cash, and then the next bit is you gotta turn that cash into revenue growth,” Gillis said. He recommended a Hold rating for the stock.

Equity Risk

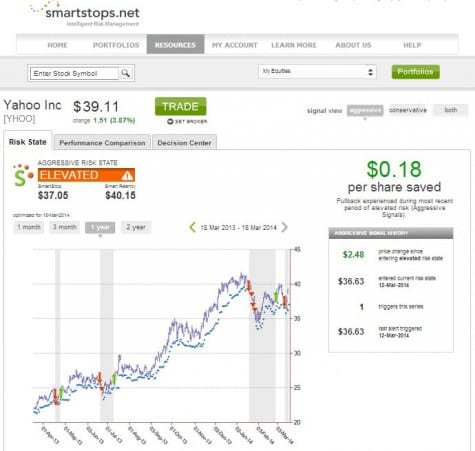

Smartstops.net, an equity risk management firm shows that the shares of Yahoo! Inc. (NASDAQ:YHOO) are currently at elevated risk state. The stock entered its current risk state on March 12 when it traded around $36.63 per share.