Want to form a Limited Liability Company for your business but unsure about which type of LLC to choose? Then, this article is for you.

Limited Liability Companies are one of the most popular entity types for startup owners. The reason many startup owners choose this business structure is because of the flexible management structure and taxation options that it offers.

However, there are different types of LLCs based on their ownership, management structure, and taxation. Let’s find out what makes them different from each other and which type of Limited Liability Company you should form for your business.

Types of LLCs: Based on the Number of Members

People who start an LLC are called “members” and your company can have one or more members. Those members may include individuals, consultants, and corporations. However, banks and insurance companies cannot be members of a Limited Liability Company.

Based on the number of members (owners) your company has, you can choose the right type of LLC for your business.

1. Single-Member Limited Liability Company (SMLLC)

You can form a single-member Limited Liability Company as a solopreneur. It is similar to an LLC when it comes to ownership and liability protection but it is taxed as a Sole Proprietorship.

This legal entity type is disregarded as a separate entity from the owner but only for tax purposes. As the owner of a single-member Limited Liability Company, you will have to show your company profits and losses on your personal income tax return.

However, this disregarded entity designation doesn’t affect your limited liability protection, which means that your personal assets are guarded against company debts and lawsuits.

You can also choose your company to be taxed as a Corporation or an S-Corporation.

You need to register your single-member Limited Liability Company with the Secretary of the State’s office in the state where you want to form the company. You can either do it yourself or use a filing service like GovDocFiling to do it for you.

2. Multi-Member Limited Liability Company

When two or more members own a Limited Liability Company as partners, it is called a “multi-member LLC.” There is no maximum number of members you can have.

By default, these companies are taxed as Partnerships. If you form a multi-member Limited Liability Company in partnership with someone else, the profits and losses of your company will be passed to the personal income tax return of each of the members of the LLC.

However, you and other members can also decide to have your Limited Liability Company taxed as a Corporation or an S-Corporation.

Types of LLCs: Based on Management Structure

As suggested by Best LLC, limited liability companies offer flexibility in terms of management structure. You can choose the type of LLC based on the operational needs of your business. The decision you make will influence how your company will be managed.

3. Member-Managed Limited Liability Company

You can also choose to form a member-managed Limited Liability Company in which all members of the company actively participate in decision making. The LLC members (owners) can collectively make operational decisions to govern how your company will function.

4. Manager-Managed Limited Liability Company

You and other members of your LLC can choose and appoint one of your members as a manager. In fact, you can appoint more than one manager for your company. Then, the appointed manager(s) will be able to make all operational decisions of the company. Such an LLC is called a “manager-managed Limited Liability Company.”

Types of LLCs: Based on the Location of Your Limited Liability Company

There are two different types of LLCs based on the location where you want to form your Limited Liability Company.

5. Domestic Limited Liability Company

An LLC is known as a domestic Limited Liability Company in the state where it has been established and operates. For example, if your LLC is set up in California, it will be considered a domestic LLC throughout the state.

6. Foreign Limited Liability Company

When you operate your business in a particular state but form your LLC in a different state, it will be considered a foreign Limited Liability Company.

You may be wondering why would a business owner form an LLC in a state other than the one they want to operate their business in. You may be surprised to learn that forming a foreign LLC is a common choice among entrepreneurs whose home state does not have business-friendly laws.

Some states offer extra benefits to LLC owners such as advantageous tax rates and cost-effective formation fees. You can choose to form your Limited Liability Company in one of these states and then run your business as a foreign LLC owner.

Here is one point to note: You need to have a physical street address in the state where you want to register your foreign Limited Liability Company.

Other Types of LLCs

We’ve already discussed the different types of LLCs based on their ownership and management structures. However, that’s not all. There are some other types of LLCs as well.

7. Limited Liability Partnership (LLP)

A limited liability partnership or an LLP is similar to a Limited Liability Company when it comes to liability protection. The only difference is that an LLP operates under the rules of a Partnership.

You can form an LLP with one or more partners to run your company as a Partnership while limiting your liability for company debts and lawsuits.

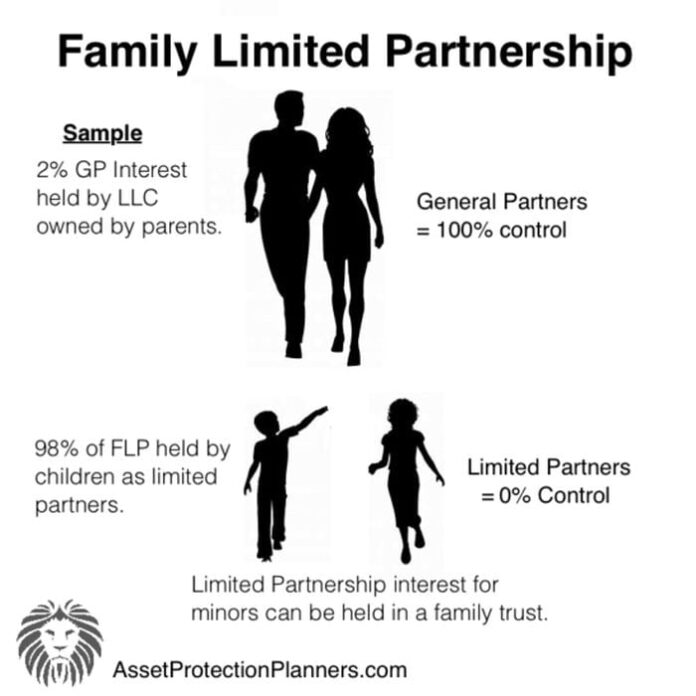

8. Family Limited Partnership

This type of LLC is owned by family members. Family members usually form a Limited Liability Company as a limited or general partnership when they want to convert their property into a company asset.

By forming this type of LLC, you can give control of your family property to any member of the LLC.

Are You Ready to Form a Limited Liability Company for Your Business?

There are many types of LLCs you can form as a small business owner. You should choose the Limited Liability Company type that best fits the ownership, operational, and taxation needs of your business.

We are sure that the points we have mentioned above about each type of LLC will help you make an informed decision. However, if you’re still unsure about which type of LLC you should form, feel free to discuss it with us in the comments below.